Content

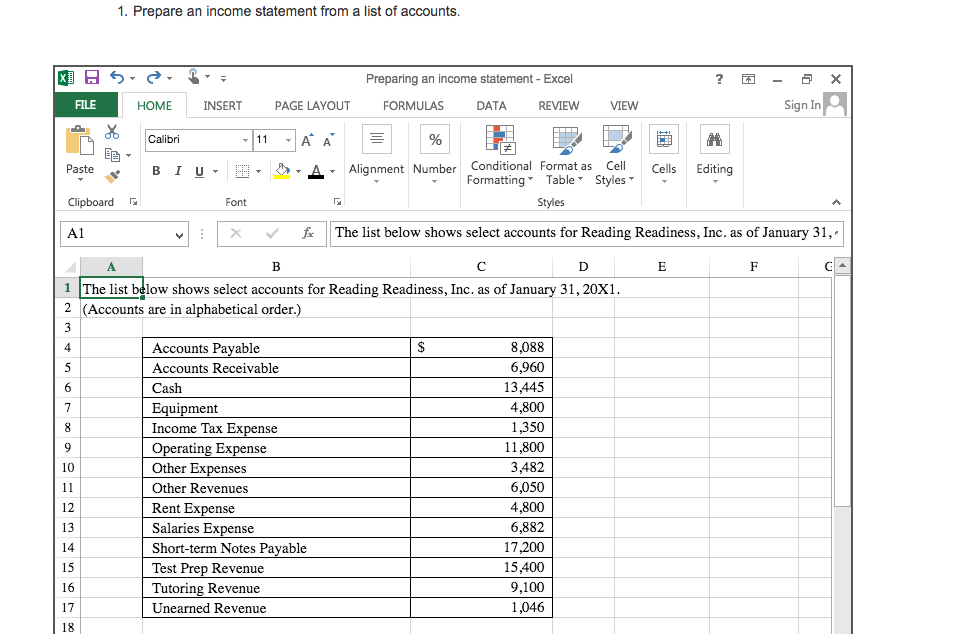

Jennifer VanBaren started her professional online writing career in 2010. She taught college-level accounting, math and business classes for five years. Her writing highlights include publishing articles about music, business, gardening and home organization. She holds a Bachelor of Science in accounting and finance from St. Joseph’s College in Rensselaer, Ind. Explain why there may be a difference between the bank statement ending cash balance and the ending balance in the Cash account.

What are the 2 forms of balance sheet?

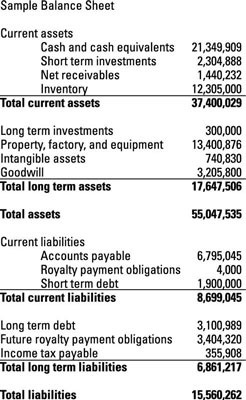

Standard accounting conventions present the balance sheet in one of two formats: the account form (horizontal presentation) and the report form (vertical presentation).

Efficiency – By using the income statement in connection with the balance sheet, it’s possible to assess how efficiently a company uses its assets. For example, dividing revenue by the average total assets produces the Asset Turnover Ratio to indicate how efficiently the company turns assets into revenue.

Resources for YourGrowing Business

Investment property, such as real estate held for investment purposes. If you are new to accounting the next thing I would read about would be the Income Statement or the Cash Flow Statement. The Capital Category shows that owners have input USD 1,000,000 into the business in return for ownership in the company. An Accrued Expense Balance of USD 700,000 shows that the company has incurred some liabilities which are due to be paid within the next 12 months. The Prepaid Expense Row of USD 300,000 show Expenses paid in Advance. Prepaid Expenses often include Rent, Insurance, Subscriptions amongst other expenses paid in advance.

- FreshBooks provides a range of income statement and balance sheet examples to suit a variety of businesses, no matter if you have just started out or if you are looking for a different solution.

- When combined with income from operations, this yields income before taxes.

- Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month.

- By examining a sample balance sheet and income statement, small businesses can better understand the relationship between the two reports.

- Here are some of the best accounting software solutions, with budget pricing and intuitive user interfaces that can make accounting less daunting.

This line item includes all of the company’s intangible fixed assets, which may or may not be identifiable. Identifiable intangible assets include patents, licenses, and secret formulas. Along with the cash flow statement, they comprise the core of financial reporting. Errors or omissions in either of them create inaccurate results across all of them.

Assets

An income statement is one of the three major financial statements that report a company’s financial performance over a specific accounting period. The balance sheet shows a company’s resources or assets, and it also shows how those assets are financed—whether through debt under liabilities or by issuing equity as shown in shareholder equity. The balance sheet provides both investors and creditors with a snapshot of how effectively a company’s management uses its resources.

- A typical balance sheet is reported in Figure 3.5 “Balance Sheet” for Davidson Groceries.

- The balance sheet summarizes the recorded amount of assets, liabilities, and shareholders’ equity in a company’s accounting records as of a specific point in time .

- It includes profit& loss account, balance sheet, and cash flow statement.

- In the previous example, we found out the end balance of the cash account and capital account.

- Accrual Vs. DeferralAccrual is the process of recording revenue or expenses that have not yet been settled.

Because it shows goodwill, it could be a consolidated balance sheet. Monetary values are not shown, summary rows are missing as well. Deferred Tax LiabilitiesDeferred tax liabilities arise to the company due to the timing difference between the accrual of the tax and the date when the company pays the taxes to the tax authorities.

Gross capital balance sheet format

Balance sheets can either be in the report form or the account form. A Balance Sheet is a Financial Statement which gives the reader a ‘snapshot’ of the companies financial condition at a given point in time. It lists out what the company owns and what the company owes giving insights into the overall health of the business.

Other revenues or gains – revenues and gains from other than primary business activities (e.g., rent, income from patents). The difference between the assets and the liabilities is known as ” equity “. Where you can calculate Ratios such as Current ratio, Quick Ratio and Debt to Equity Ratio which gives you deep insights into the performance Difference Between Report Form and Account Form Balance Sheets of the company and become a better decision maker with regards to the business. The Short Term Bank Overdraft and Long Term Bank Loans balance shows that the company has borrowed money from banks. Debt balances are of particular interest to readers of Financial Statements since they reveal significant details of the company.

Report Form

Just like the other financial statements, the balance sheet is used to conduct financial analysis and to calculate financial ratios. Below are a few examples of the items on a typical balance sheet. The information is divided into the general classifications of assets, liabilities and equity. As a rule, the total amount of the company’s assets is equal to the total amount of its liabilities plus the owners’ equity in the company. This equation must always balance, with the same amount on each side of the sheet. The income statement is the most important of the financial statements, because it reveals basic truths about the financial performance of a company for a given reporting period. Beginning with sales, it subtracts expenses and arrives at a net profit or loss, and, in the case of publicly reported companies, an earnings-per-share figure for investors.

- A balance sheet can be presented in account form and report form, but first, it is important to have a basic understanding of the types of financial statements to prepare and why they are important.

- Bearer biological assets are plants or animals which bear agricultural produce for harvest, such as apple trees grown to produce apples and sheep raised to produce wool.

- The balance sheet shows a company’s resources or assets, and it also shows how those assets are financed—whether through debt under liabilities or by issuing equity as shown in shareholder equity.

- For now, suffice it to say that depending on a company’s line of business and industry characteristics, possessing a reasonable mix of liabilities and equity is a sign of a financially healthy company.

- The blank balance sheet template can be downloaded in a range of formats to suit your preferred software program, from Microsoft Excel and Microsoft Word to Google Docs or Google Spreadsheets.

Here is a quick reference for the key differences between the balance sheet and income statement, summarizing what we’ve discussed above. Shareholder’s equity also includes retained earnings – the portion of the net income that hasn’t been distributed to shareholders as dividends – to be used for funding further growth and expansion https://online-accounting.net/ of the business. This segment of the balance sheet includes return of equity , calculated by dividing net income by shareholder’s equity. ROE measures management’s effectiveness in employing and driving returns based on equity. It is obligatory for every company to furnish its financial statements publicly at the end of the period.